2025 Housing Market Reality Check: Still Tight, Still Expensive, Still Competitive

Let’s get one thing straight: 2025 did not turn into a buyer’s market. Anyone waiting for prices to fall or sellers to panic was mostly disappointed.

Yes, the market loosened a bit—but only a bit.

Sales held firm. Nearly 68,000 homes and condos closed across Northwest Washington, pushing more than $55 billion in sales volume. That’s basically flat from 2024, which tells you demand never went away—it just got more selective. Compare this to 107,000 homes sold in 2021!

Prices refused to budge. The median price landed at $644,500, and in places like King County, single-family homes pushed close to $1 million. If you were expecting a meaningful price correction, it didn’t happen. Desirable areas stayed expensive, period.

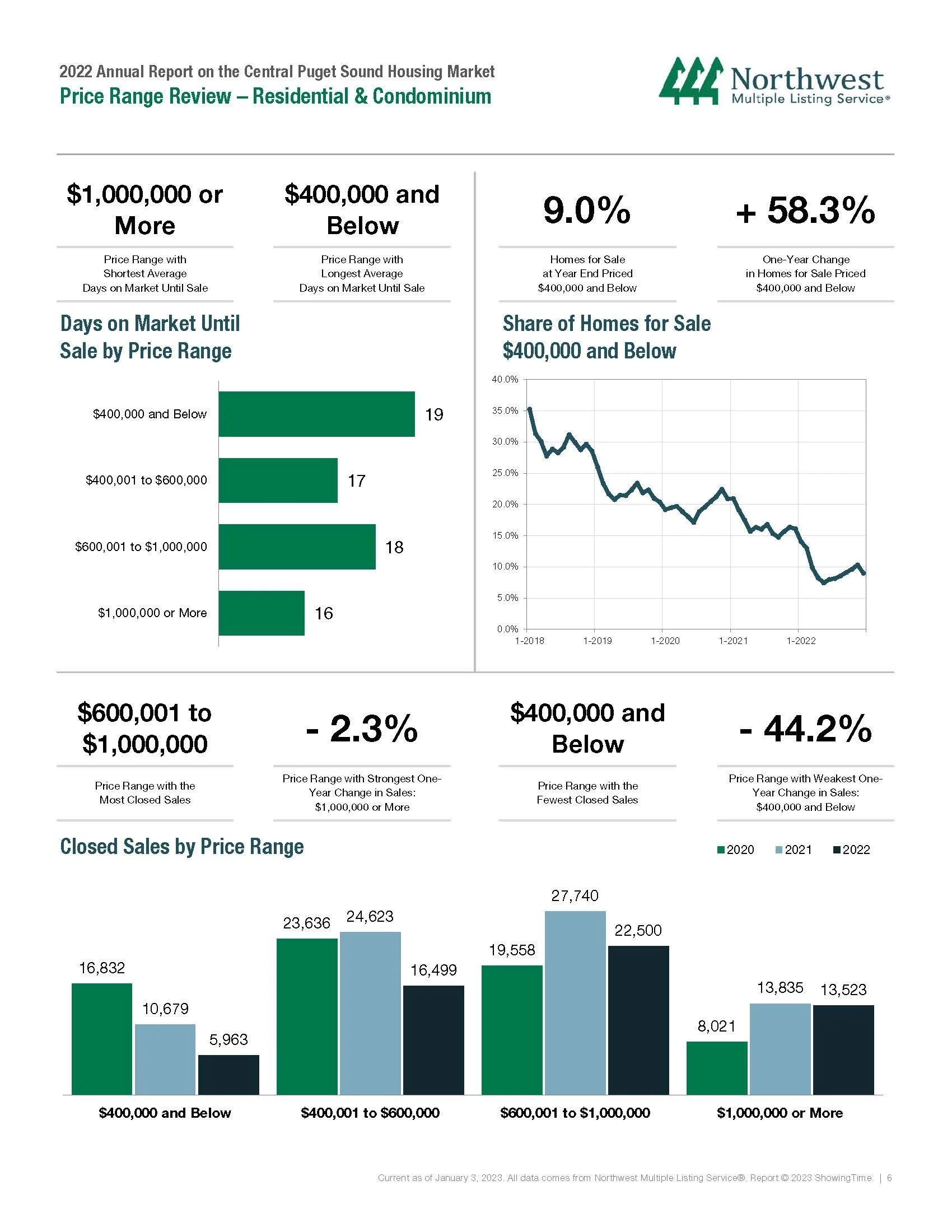

Inventory improved—but don’t get carried away. Listings were up and buyers finally had more than a handful of homes to choose from. That’s the good news. The bad news? We still averaged under three months of supply, which is nowhere near a balanced market. Sellers with well-priced, well-presented homes still had the upper hand.

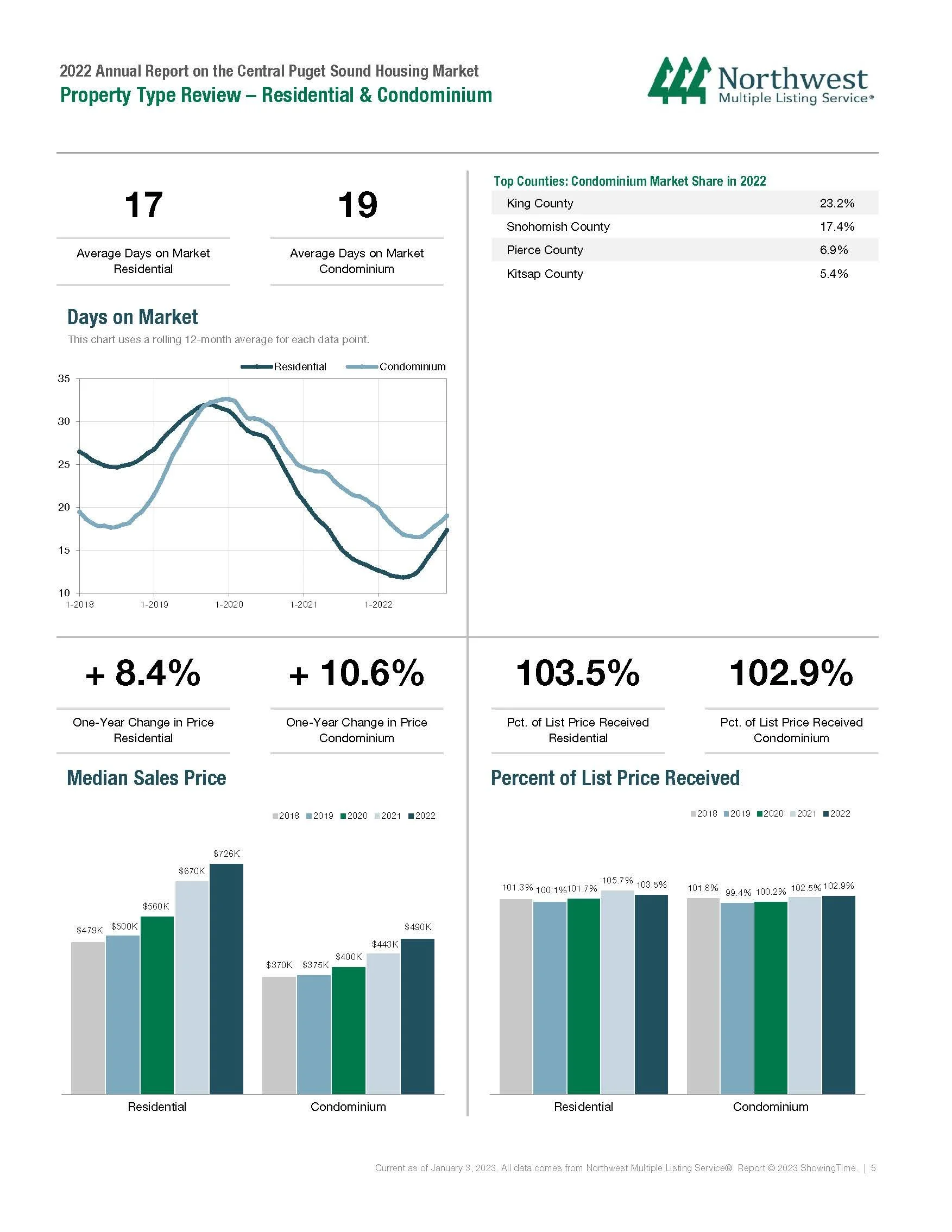

Homes sold for almost full price. On average, sellers walked away with 99.6% of their asking price. Translation: buyers gained negotiating power at the margins, not leverage. Overpriced homes sat. Everything else sold.

Condos and new construction didn’t save affordability. Condos made up a small slice of sales, mostly in King County, and new construction came in at premium prices—$720K for new homes and $900K for new condos. That’s not relief; that’s just a different flavor of expensive.

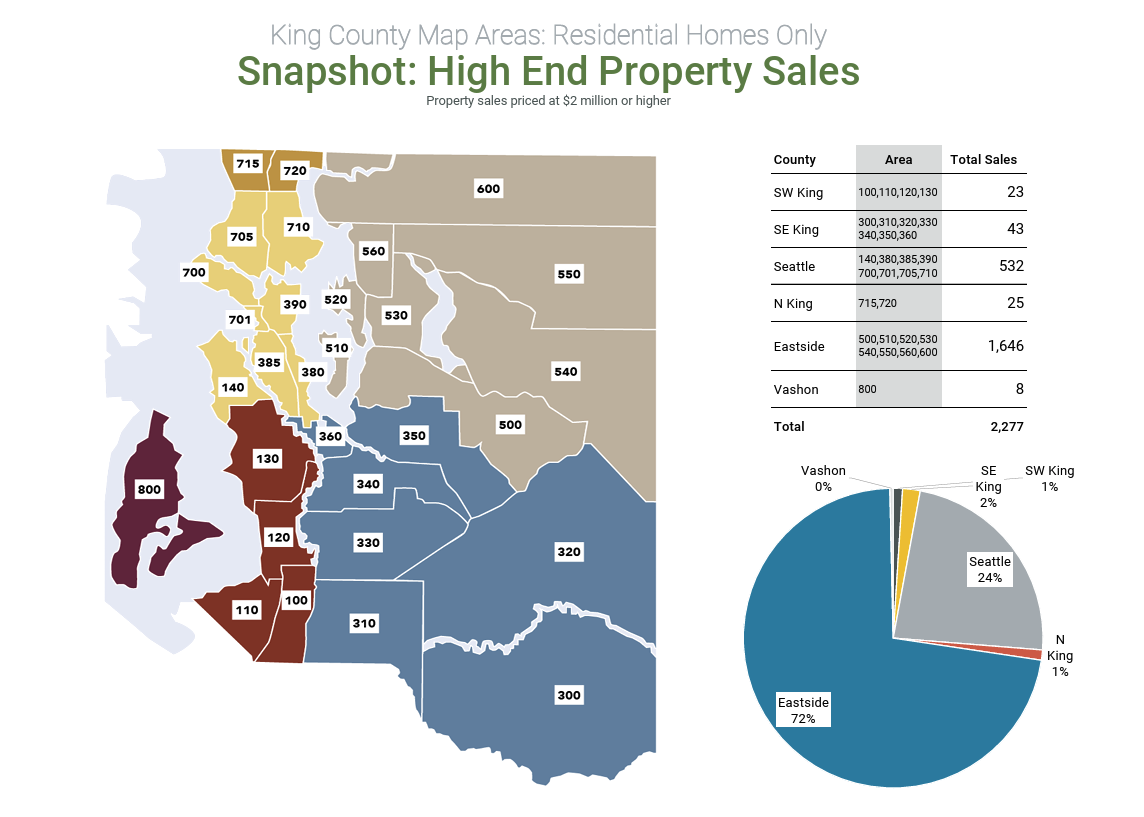

The luxury market didn’t flinch. Thousands of homes sold above $2 million, and million-dollar condos continued to move. High-net-worth buyers never left—they just became more patient and more demanding.

June had the highest sales price by nearly $20,000 compared to May in 2024.

The real takeaway

2025 rewarded realistic sellers and prepared buyers. The days of throwing a house on the market and naming your price are over—but so are the dreams of scoring a massive discount just for showing up.

This market wasn’t about timing—it was about pricing right, understanding micro-markets, and executing cleanly. And that’s exactly what will matter going forward.